Own a vacation rental or AirBnB in Osceola county? Here is how to pay Osceola County tourist tax for vacation rentals. airbnb cleaner

Occupancy Tax aka Osceola County Tourist Tax

What exactly is tourist development tax?

The Tourist Development Tax is a charge on the total rental amount charged to a guest for any short term rental (less than 180 days).

Osceola vacation rental tax for Dummies

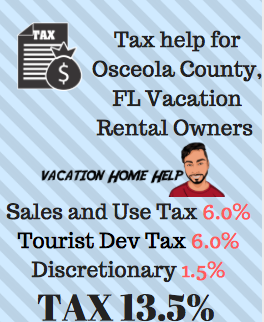

Ok, none of my readers are dummies of course, but here is a simple breakdown of total taxes you must collect and remit as a vacation rental owner (read on AirBnB hosts).

Rental income you collect is subject to sales and use tax from Florida and Tourist Development Tax from Osceola. Infographic explains breakdown of tax: airbnb cleaners

State and local governments usually have an occupancy tax you must pay. Best place to find out about the applicable occupancy taxes are online at your local tax collectors website. My tax collector’s website is here and I found it by Googling “local tax collector” you can do the same. In my county, taxes total to 13.5% of which 6% is tourist development tax. AirBnB collects taxes for some localities and remits it on your behalf, so it is important to check with AirBnB for tax information.

Occupancy taxes are due monthly through a local tax return form. Beware of penalties and fees for not filing on time, even jail time. If you have a question about your tax situation, I am happy to help an owner out, contact me and I will do my best to respond.

Osceola County Tourist Tax for AirBnB Hosts

AirBnB collects all Florida state sales tax, but does NOT collect tax for Osceola as it does for other counties. What does this mean? You must remit a monthly tourist tax return to Osceola county.

Osceola County Tourist Tax for HomeAway, VRBO, and FlipKey

Set tax rate to 13.5%, by doing so you are collecting the proper occupancy tax for your vacation rental.

How to pay tourist development tax for my vacation rental in Osceola

Step 1 : File the Osceola County Tourist Development Tax Application

I have taken the liberty of linking a copy of the tourist tax form for your convenience here. If you have trouble filling this out, comment below. Pay $5 fee to mail into Bruce Vickers, Osceola Tax Collector.

Step 2: Know the tourist development tax due dates to avoid penalities

You can either report at a monthly or quarterly frequency. New applicants must report monthly for the first year. The due date is on the 20th day of the month.

Step 3: File Tourist Tax Return and Pay Taxes

The tax return form is here. I am an accountant by trade and help vacation home owners with their taxes all the time, so let me know if you need any help or assistance. You can pay taxes with cash, check, or credit card but for some strange reason, they do not accept VISA.

Even if you have not collected any income, file what is called a zero return. This means you still need to notify Osceola you collected no income. This is important to avoid fees!

How to pay Florida state sales tax for my vacation rental

First off, if you are an AirBnB host, and only use AirBnB, then you are lucky. Florida has a deal with AirBnB where they collect and remit for you. Unfortunately, Osceola county has not worked this deal out yet, so you are responsible for remitting. What about vacation home owners who do not list solely on AirBnB? More tax work!

To avoid late payment fines, penalties, and worse, jail time, please make sure your home is compliant with Florida regulations and standards before proceeding. Next, read my latest post to learn how to set up your vacation rental to be compliant with Florida state and local regulations and laws.

After hopefully reading the post in the link above, you are registered to collect sales tax with the Florida Department of Revenue. After registering, your Florida vacation rental will be assigned a filing frequency of:

- Annual Filing Frequency: Due the 20th of January. As an example, sales tax collected in 2017 is due January 20, 2018. Annual filing frequencies are rarely assigned to vacation rental home owners.

- Quarterly Filing Frequency: Due the 20th of the month following the close of the quarter. As an example, sales tax collected in Q1 (January, February, and March) is due April 20th.

- Monthly Filing Frequency: Due the 20th of the month following the close of the filing period. As an example, sales tax collected in March is due April 20th.

Osceola County tourist development tax, you must file a return even if you generate 0 revenue or there will be penalties to pay. Minimum penalty is currently $50.